Guest blog: Alternative providers of higher education and the opportunities for investors

)

Mark Jeynes, Partner at CIL Management Consultants, explains the opportunity for investors in relation to Alternative Providers of Higher Education (APs).

Alternative Providers are described by HESA as higher education providers who do not receive recurrent funding from the Office for Students (previously HEFCE) or another public body and who are not further education colleges.

The AP market is fragmented. There are currently c.340 APs registered with the Office for Students, of which c.40 had a student intake of >250 in the 2021/22 academic year.

The AP model of higher education presents several attractive characteristics.

Context: Growing demand for higher education

By way of context, the wider higher education sector in the UK is in growth, with UK higher education institutions (HEIs) expecting continued growth in student enrolments to 2024/25. Key drivers include increasing higher education participation, higher volumes of school leavers and ongoing demand from international students.

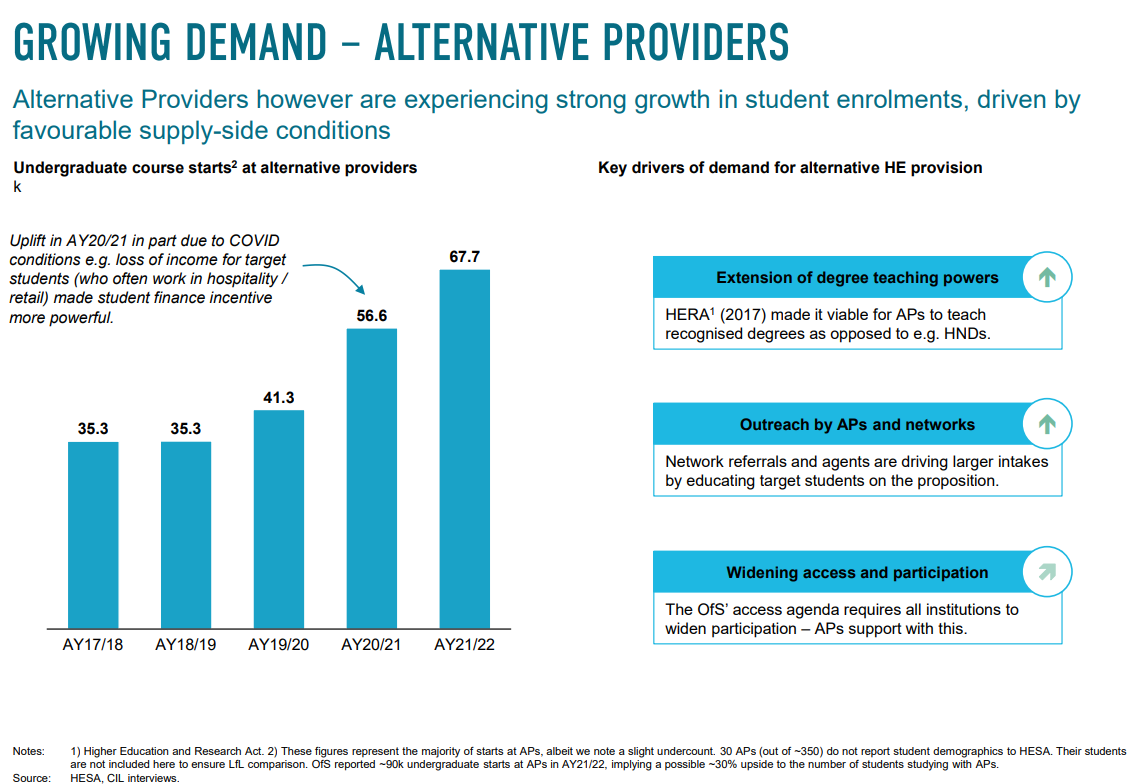

APs are however experiencing strong growth in student enrolments, driven by favourable supply-side conditions. For example, the Higher Education and Research Act of 2017 made it viable for APs to teach recognised degrees, rather than simply HNDs. Meanwhile, network referrals and agents are driving larger intakes by educating prospective students on the proposition.

The AP proposition appears particularly well positioned to target those segments of the population where demand for degrees is growing most quickly – namely mature learners, BAME students and urban communities.

APs increasingly valued by other market participants

In addition to these supply-side drivers, the role played by APs in the higher education market is increasingly valued by other participants:

- Traditional universities: Given the financial challenges faced by traditional HEIs, universities are increasingly looking to alternative revenue streams to bolster finances. APs, via their ‘franchise’ model, can provide an attractive source of income without placing additional strain on university resources.

- Regulators: The Office for Students has highlighted ‘widening participation’ as one of its key objectives. Universities must now publish Access and Participation Plans, detailing how they will improve equality of opportunity for under-represented groups to access, succeed in and progress from higher education. APs, with their established traction across non-traditional student cohorts, are well placed to support traditional universities in the recruitment of these often hard-to-reach students.

Suitability of proposition

A typical AP student may be mature (aged 25+ years), living in an urban area and often lacking formal academic qualifications.

The propositions offered by APs have enabled them to target students that traditional universities often struggle to reach:

- Flexible admissions criteria: APs consider candidates holistically – e.g. professional/ life experience can be taken into account, rather than pure academic attainment. In contrast, traditional universities tend to focus on UCAS points.

- Flexible timetables: Many target students, given their age, have other commitments such as full-time work or childcare. APs offer weekend and evening classes, providing scope for students to manage other commitments alongside their studies.

- Local study: Given their other commitments, most target students are not likely to consider moving to a campus university. APs’ urban locations, enabling students to live at home, are therefore key.

- Tailored learning environment: Compared to traditional universities, APs are used to handling students with non-traditional academic backgrounds. They typically have more robust support structures (e.g. small class sizes and an emphasis on academic and pastoral support) to enable these learners to thrive.

Favourable economics

APs achieve attractive margins, with some of the larger platforms – e.g. QA Higher Education, Global Banking School, London School of Science and Technology, UK College of Business and Computing and Regent College – delivering EBITDA margins in the c.25% range. While many traditional universities are ‘struggling’, APs are able to operate profitably due in large part to smaller, more ‘targeted’ cost bases. For example, their campuses tend to be smaller and operated more efficiently.

Scale APs can recruit students through multiple channels (agents, digital marketing, personal referrals and school partnerships) and at manageable costs. Given most students undertake four-year courses (a foundation year, followed by a three-year undergraduate degree programme) generating £30-35k revenue per student, LTV/CAC dynamics are attractive.

Multiple value creation levers

APs have multiple growth levers:

- Maximising earnings at existing sites: Careful capacity management, the introduction of blended courses and investment in student acquisition can meaningfully improve site-level performance.

- New site roll-out: Once operators have developed a proven model for acquiring students and delivering quality tuition, the model can be replicated across new sites. Several major regions in the UK appear to be relatively underserved by APs, suggesting meaningful white space for growth.

Potential ‘watch outs’

Whilst overall market conditions appear supportive of further growth across the AP space, some market dynamics pose risk:

- Office for Students regulation: The Office for Students has taken on responsibility for both regulation and assessment across the higher education sector. Market commentary suggests a more ‘hands-on’ approach to ensure value for money for both students and taxpayers.

The Office for Students has outlined a set of quantitative standards (‘B3 conditions’) that providers must meet. Given the non-academic background of many AP students, meeting these standards may be more challenging for APs compared to traditional universities. These regulations also highlight the importance of robust admissions processes, which can act as a break on growth.

- University withdrawal from franchise model: Universities act as ‘gatekeepers’ to the provision of degree-level courses by APs, who require a university partner. If universities opt to withdraw from the franchise model, this could constrain the volume opportunity accessible by APs.

The key risk of AP partnerships for universities is poor academic attainment by AP students. Under the franchise model, teaching is essentially ‘outsourced’ to APs, meaning the academic attainment of AP students is included within the traditional university’s B3 scores, just as if these students were ‘taught’ in-house. Given increasing scrutiny around academic attainment and potentially harsher penalties for missing attainment thresholds, the risk profile of franchise arrangements may be perceived as less attractive by some traditional HEIs.

- Tuition fee caps: Tuition fees for domestic students have been capped at £9,250 since 2017, with domestic fees remaining frozen until 2024/25 at the earliest. The real value of tuition fees will therefore continue to fall given ongoing inflationary pressures.

Furthermore, recently announced policy reforms have suggested that fees for foundation year programmes will be capped at £5,670 from 2025/26 (versus £9,250 today). Given most AP students enrol on four-year programmes, which include a preparatory foundation year, APs may be more exposed to this reform – if implemented – than traditional universities.

- Vocational options: The Lifelong Loan Entitlement is expected to go live in 2025/26. It aims to provide greater opportunity for learners, opening student finance to vocational options. In the long-term, this could have some impact on demand for courses offered by APs, as target students could opt for more vocational courses over the recognised degrees that APs currently specialise in.

-

Mark Jeynes

Partner, CIL Management Consultants

.svg)