Guest blog: Emerging markets bring opportunities for the international development of independent schools

)

According to data collected by ISC Research, Asia dominates the international schools market with 57% of all international schools – a total of 7,774 international schools as of July this year (2023), teaching a total of 4.3 million students aged between 3 and 18.

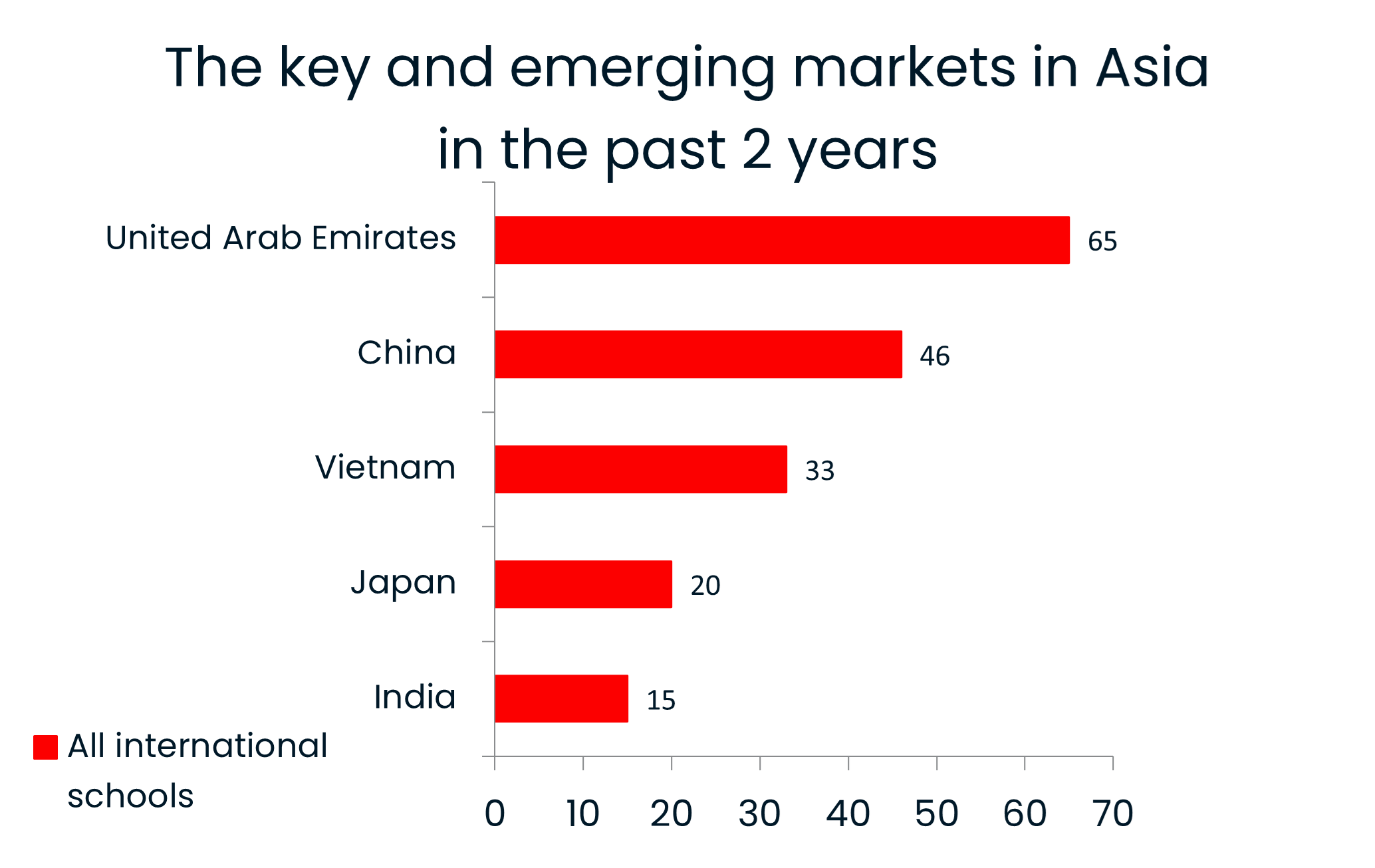

ISC Research data highlights the countries with the highest percentage of new international schools opening in Asia since July 2021 as the United Arab Emirates (UAE), China, Vietnam, Japan and India. These countries have been identified as key and emerging markets in the education sector over the past two years and represent 40% of all international schools opened in this time period.

Source: ISC Research, July 2023

Fuelling demand in Asia’s key and emerging markets

The UAE and China have been key markets for many years and remain important. Vietnam emerged a few years ago, and its international school numbers have kept increasing since.

The UAE has witnessed a notable rise in the expatriate population. This influx of expatriates, coupled with substantial urban development in Dubai, Abu Dhabi, and Sharjah, is expected to lead to the establishment of more international schools. In Dubai, largescale infrastructure projects, as well as projections of nearly doubling the population within two decades, are driving the development of additional international schools. These schools are being strategically situated to support emerging community suburbs as the city expands.

In China, the strict restrictions on host nation children attending international schools continue to impact enrolment nationwide. However, there is a strong desire for international education among young Chinese families, leading some to seek whatever access they can. Only 30% of the 46 schools were established within the last 12 months, indicating a potential market slowdown, possibly due to changes in regulations. Despite these challenges, China remains a market with a huge international schools presence, and one whereby many are still exploring opportunities within the new regulatory framework.

There has been a notable increase in the desire for international school education in Vietnam among families in various countries within Asia Pacific. The extent of this demand is often dependent on an affordable fee point for these parents. Furthermore, there is a growing demand from expatriate families who have relocated to Vietnam. The lower cost of living in certain Southeast Asian countries, combined with the potential for extensive travel opportunities, makes these countries particularly attractive to expatriates.

Interestingly, Japan and India have emerged as growing markets in the past two years. In Japan, the demand for international education among host national families remains relatively low. However, the country is experiencing an increase in the number of expatriate families, particularly from China, who are relocating to Japan to provide their children with early access to international education. This year, Japan will witness the opening of two high-profile British independent school brand schools.

India: a fast-growing market

With nearly 900 international schools in India already, including 15 new schools opened in the past two years and 33 future schools in development, the international schools market in India is growing at a considerable rate. ISC Research's intelligence reveals that despite a decrease in expatriate enrolment caused by the pandemic, the overall student numbers in certain international schools have actually increased.

With the pandemic gradually subsiding, a rise in India’s affluent middle-class families has primarily driven a surge in the demand for international schools, and many expatriate students who had left the country are now returning. Consequently, some schools are planning to expand their capacity to accommodate this increased demand.

As the enrolment figures and demand continue to rise, the number of international schools in India has also grown. This has resulted in a competitive international school market in the country.

Future potential for independent schools

As the international schools market has expanded, and investment potential has increased, school groups and independent school brands are emerging within this sector that are considered influential across the global education market.

Prior to the COVID-19 pandemic, a predominant area of focus within the international schools market was China. However, post-pandemic, several other markets are now displaying positive growth indicators and more progressive regulations towards international education. The demand for international education is rising globally, presenting promising opportunities in the short-term across different regions.

In the Middle East and North Africa (MENA) region, particularly in the UAE and Saudi Arabia, there is a noticeable surge in potential as their populations grow through both birth rate and immigration. Southern Asia, notably India, with its increasingly prosperous middle classes and rapid economic growth, is also poised to become a major player in the international schools market. The region has already witnessed the opening of various independent schools and is anticipating the opening of several more, including Harrow International School Bengaluru and Wellington College International Pune, with more in the pipeline.

Looking ahead to the longer-term, Africa, with its emerging markets such as Nigeria and Kenya, and Latin America, featuring countries like Brazil and Mexico, hold strong potential for opportunities as their economies develop and demand for international education increases in line with the local population’s wealth and desire for reliable pathways to overseas higher education.

UK-based independent schools are facing pressures to consider expansion overseas for commercial reasons, including the prospect of future tax increases, inflation challenges, and rising living costs for British families. Some independent schools with an overseas campus are recognising additional advantages of going international beyond financial motives, such as cultural exchanges, sharing of teaching and learning expertise, and global brand awareness.

Education Summit

At Education Summit 2023, I will be presenting 'The current state of the global international schools market – opportunities and challenges.' The session will explore recent challenges faced by the market, highlight significant openings of new independent school overseas campuses, discuss partnership models and more. I look forward to an insightful session with a comprehensive discussion on various aspects of the international education sector.

-

)

Freddie Cloke

Head of school development, ISC Research